Challenge

The financial institution needed better visibility into market trends and customer behavior patterns to inform investment decisions.

Solution

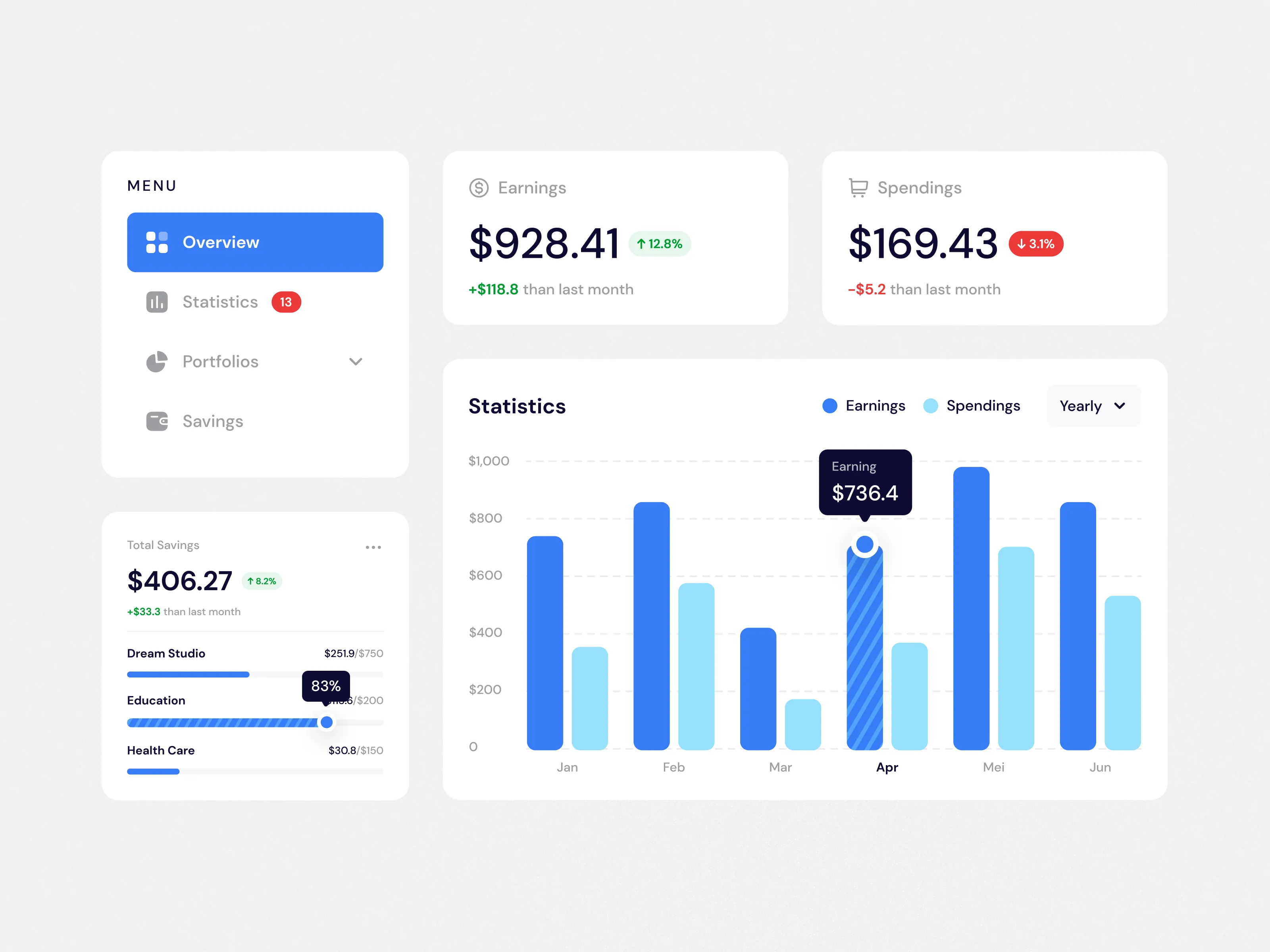

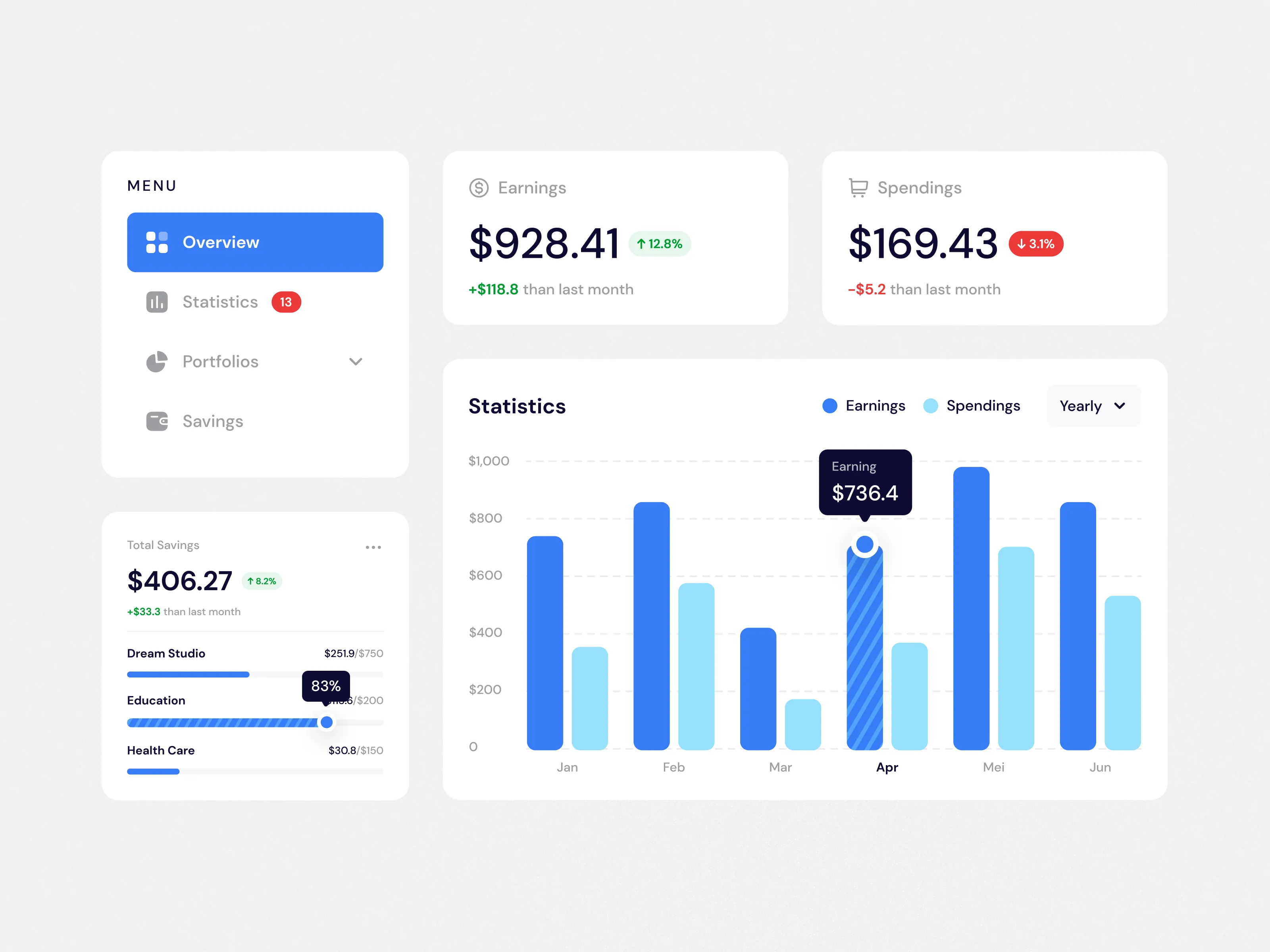

We created a real-time analytics dashboard with AI-powered predictive models that visualize market trends and forecast customer behavior.

Results

Improved investment decision accuracy by 28%, reduced analysis time by 65%, and enabled the identification of new market opportunities worth $12M annually.

1The Challenge

The financial institution needed better visibility into market trends and customer behavior patterns to inform investment decisions.

2Our Solution

We created a real-time analytics dashboard with AI-powered predictive models that visualize market trends and forecast customer behavior.

3The Results

Improved investment decision accuracy by 28%, reduced analysis time by 65%, and enabled the identification of new market opportunities worth $12M annually.

Global Finance Partners, a mid-sized investment firm managing over $2 billion in assets, was struggling to make timely investment decisions due to fragmented data sources and manual analysis processes.

Their analysts were facing several challenges:

- Excessive time spent gathering and processing data

- Limited resources for actual analysis and strategy development

- Lack of tools to identify emerging market trends and changing customer behaviors

Our Approach

We developed a comprehensive analytics solution that transformed their data operations:

- Centralized data warehouse integrating multiple internal and external data sources

- Real-time dashboard with customizable visualizations for different user roles

- AI-powered predictive models for market trend analysis

- Customer behavior forecasting based on historical patterns

- Automated alerting system for significant market movements

The solution utilized Vue.js for the frontend dashboard, with Python powering the backend analytics engine. We implemented several machine learning models using scikit-learn and TensorFlow to drive the predictive capabilities.

Implementation Process

The project was delivered through an agile methodology with four key phases:

- Phase 1: Data integration and warehouse development

- Phase 2: Dashboard design and implementation

- Phase 3: Predictive model development and training

- Phase 4: System optimization and user training

Throughout the process, we conducted bi-weekly sprints with regular demos to ensure the solution aligned with the firm's specific analytical needs.

Results

The analytics dashboard has delivered substantial value to Global Finance Partners:

- 28% improvement in investment decision accuracy

- 65% reduction in time spent on data analysis

- Identification of new market opportunities worth approximately $12M annually

- 42% increase in analyst productivity

- 30% faster response to market volatility events

The platform continues to evolve, with ongoing model refinements and additional data sources being integrated to further enhance its predictive capabilities.

ThanksDev's analytics dashboard has transformed how we process and act on financial data. The predictive capabilities have given us a significant competitive advantage in identifying market opportunities ahead of our competitors.

Project Overview

Real-time data visualization platform for financial institutions with predictive analytics.

Technologies Used

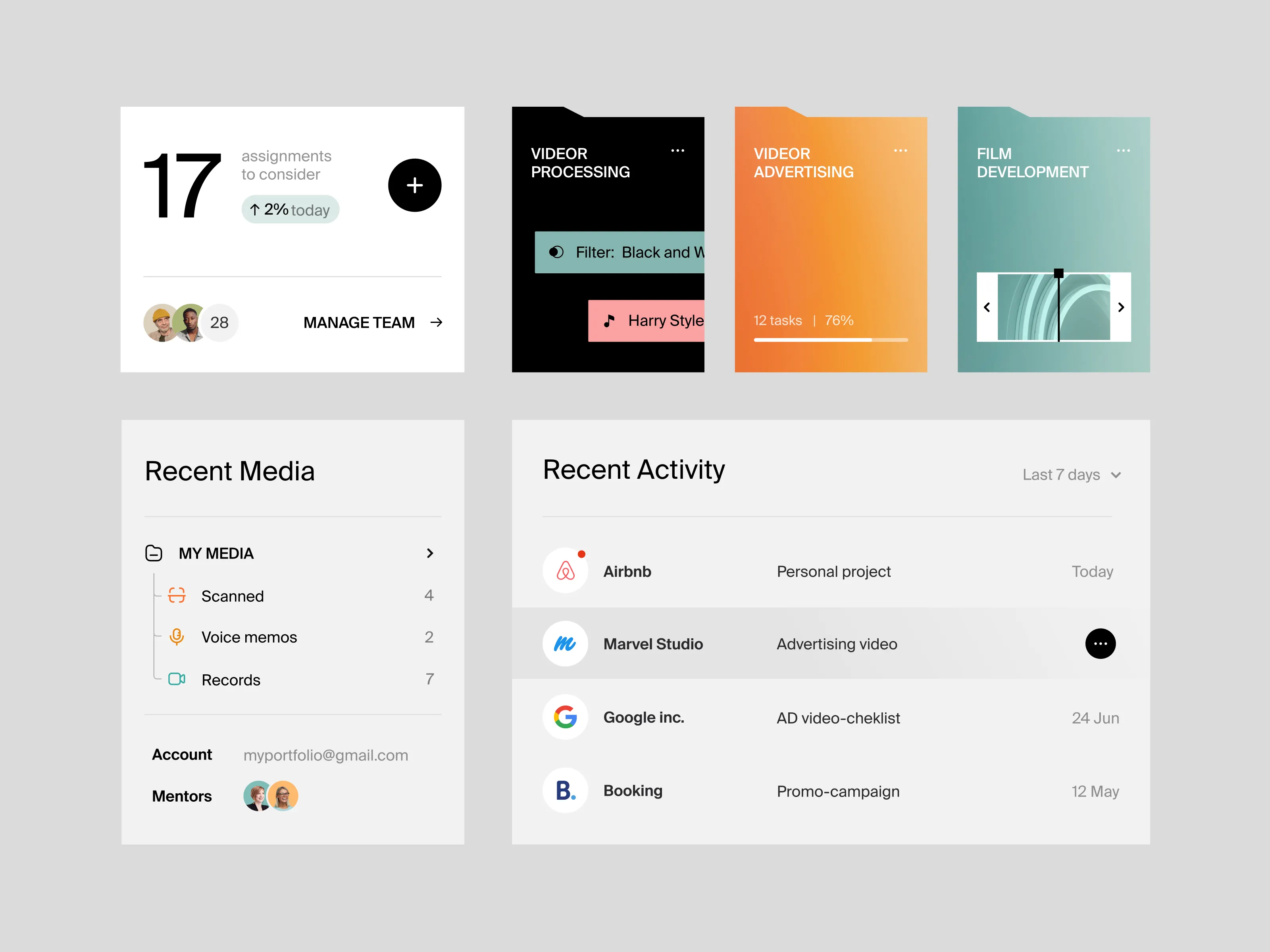

Related Projects

AI-Powered E-commerce Platform

A custom shopping experience with personalized recommendations and automated inventory management.

View case study

Customized Web Platform

Enterprise-grade web application with tailored workflows, integrated systems, and secure data management for complex business operations.

View case study